Table of Contents

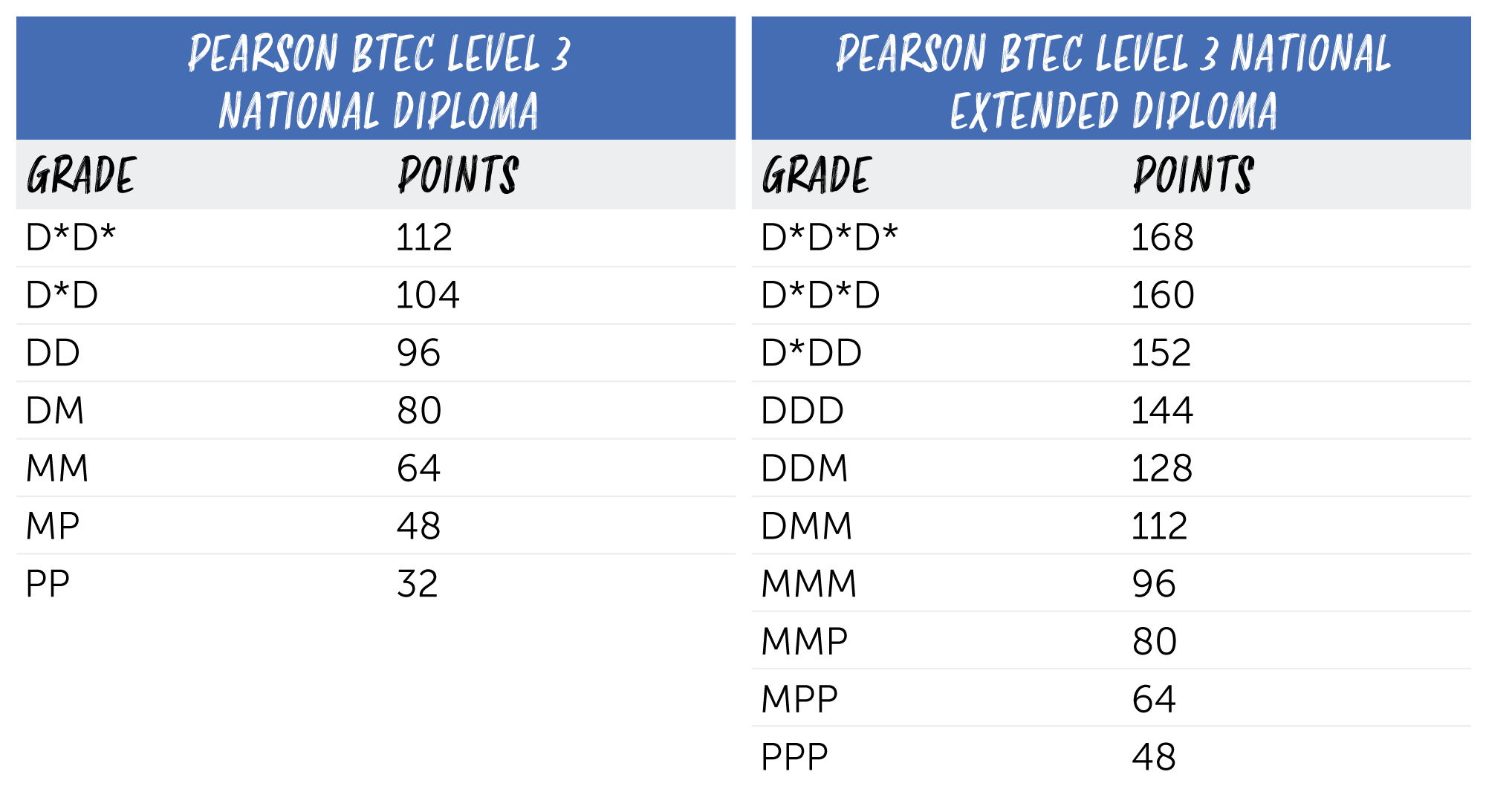

- UCAS Tariff Points - A Simple Guide | StudentCrowd

- Navigating Global Textile Tariffs: A Guide for Manufacturers

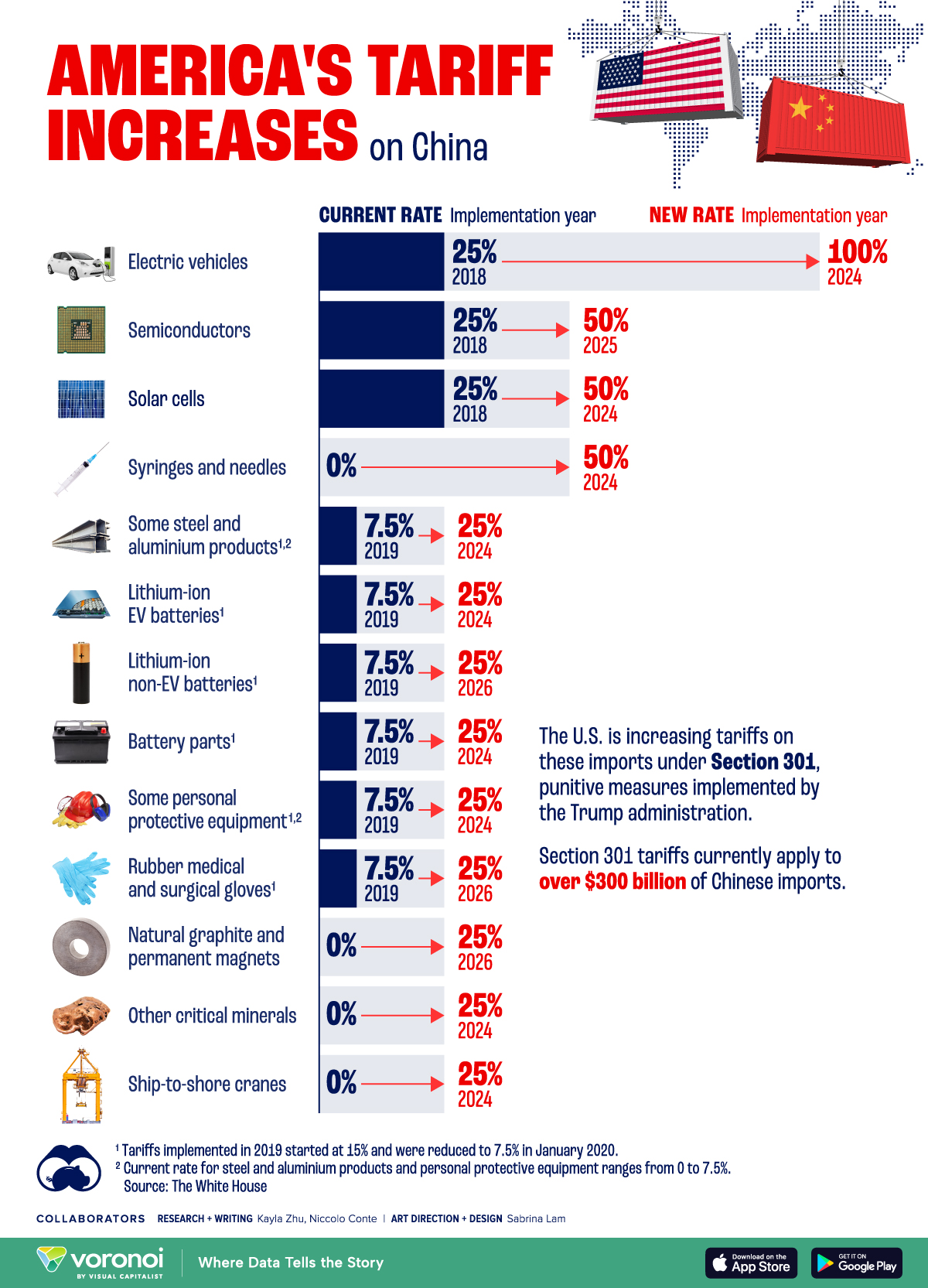

- Comparing New and Current U.S. Tariffs on Chinese Imports

- Pin on Business Finance

- Trump says Americans could feel 'some pain' from his new tariffs that ...

- What Is Tariff In Electrical, Characteristics, Types Of Tariff, Benefits

- Trump's New Tariffs on Canada, Mexico, and China: Is India Next?

- Premium Vector | Tariff vector outline doodle Design illustration ...

- Donald Trump's tariffs: What's going on and what does it all mean? | US ...

- US-China Tariff War and Apparel Sourcing: A Four-Year Review (updated ...

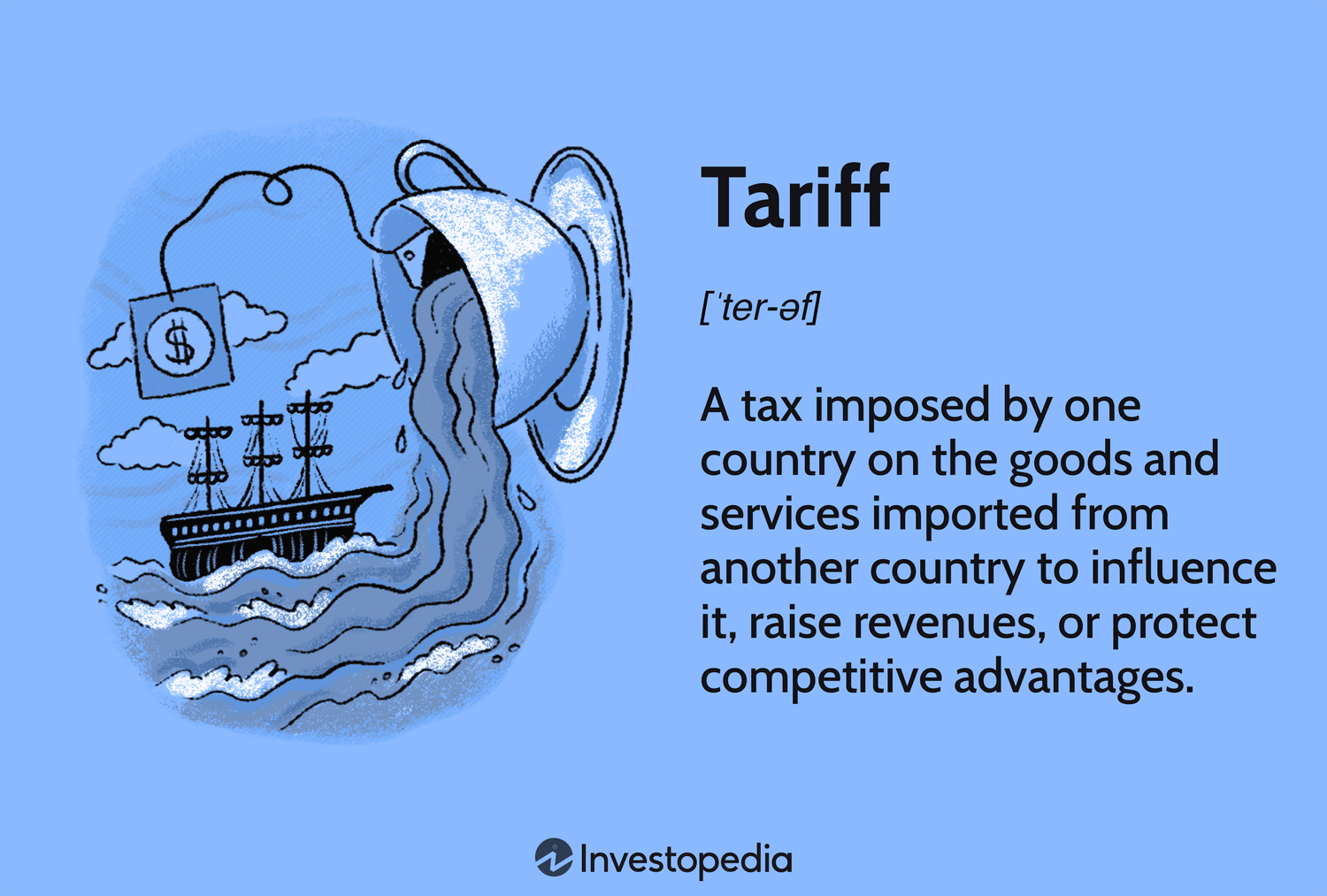

What is a Tariff?

Types of Tariffs

Who Pays the Tariff?

So, who pays the tariff? The answer is not as straightforward as it seems. While the tariff is imposed by the government, the cost is typically passed on to the consumer. Here's how it works: The importer pays the tariff to the government when the goods are imported. The importer then adds the cost of the tariff to the price of the goods. The consumer ultimately pays the higher price for the imported goods. However, the impact of tariffs can be more complex and far-reaching. For example: Domestic producers may benefit from tariffs as they become more competitive in the market. Foreign producers may be negatively impacted as their goods become more expensive and less competitive. Consumers may face higher prices for imported goods, which can lead to reduced demand and economic growth.